How to boost your payment performance

Author: Flora Wolfer - CMO of Payplug

Flora is the CMO of Payplug, the French payment solution that maximises the performance for online and brick-and-mortar merchants in France and Europe. As an established payment expert, we invited her today to share her insights and tips for merchants to deal with the challenge of offering all the necessary local payment methods when expanding their markets in Europe.

In today’s increasingly competitive eCommerce landscape, every detail matters. Although often overlooked, payment strategy is crucial in driving conversions and enhancing customer satisfaction.

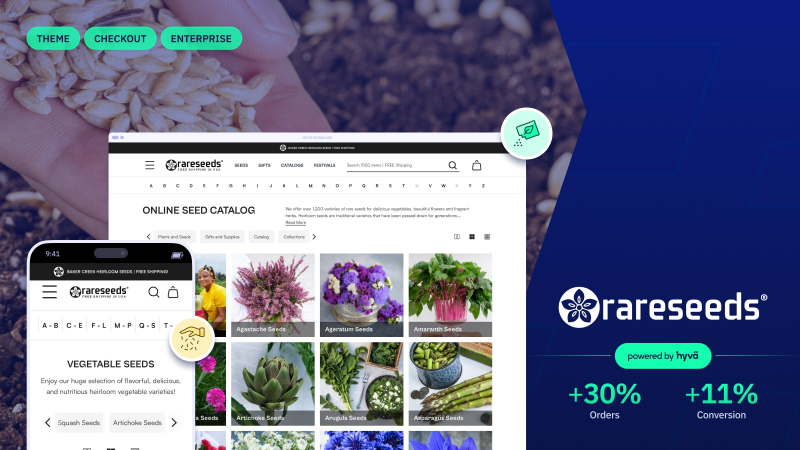

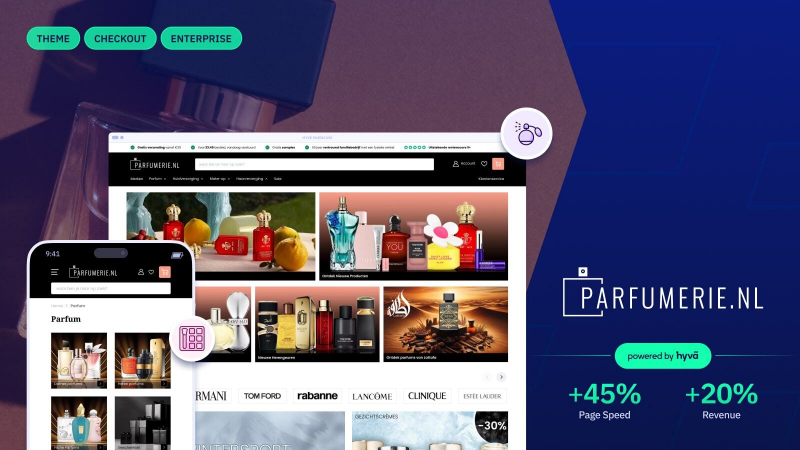

If you’re using Hyvä, you’ve already prioritised your eCommerce website’s performance. But you can go the extra mile by optimising your payment process. This is the most critical step that can make a difference between a successful transaction and an abandoned cart.

By the end of this article, you’ll understand how to transform your payment strategy into a sustainable growth driver in four simple steps.

1. Set payment objectives beyond SLA

Historically, businesses assessed their payments using technical metrics like SLA (Service Level Agreement), focusing mainly on payment platforms’ availability.

This approach is now outdated, driven by the diversification of payment methods and the emergence of localised Payment Service Providers (PSPs).

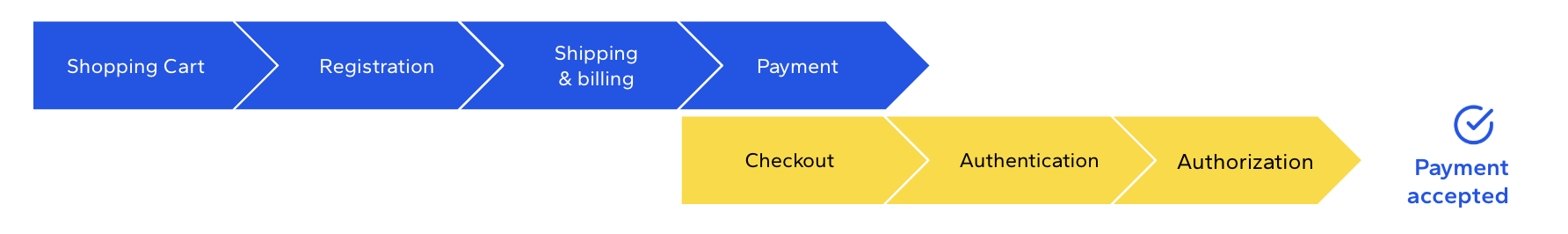

Retailers must now shift to business-focused metrics to measure performance at every stage of the payment journey, from checkout to authorisation.

Blue: a typical purchase path on an e-commerce site. Yellow: the payment funnel

Here are the key KPIs you should track:

- Conversion rate at checkout: This indicator reflects the percentage of users who complete their purchase, offering a macro view of success.

- Strong or frictionless authentication rate: Under the Payment Services Directive 2 (PSD2), strong customer authentication is mandatory unless exemptions apply. A frictionless journey occurs when users don’t need to authenticate via 3D Secure.

- Acceptance rate: Indicates the percentage of successful payments out of all attempts, highlighting the performance of your payment funnel.

- Fraud rate: Effective fraud management is essential for increasing conversion rates. We’ll delve deeper into this later in the article.

Once your objectives are set, you should implement targeted activities to improve each stage of the payment journey.

2. Optimise your checkout

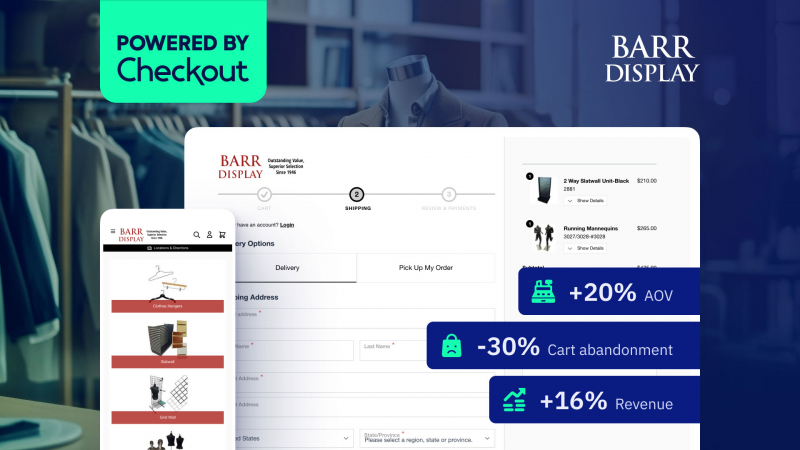

The checkout process is often the deciding factor in the customer journey. A cumbersome or poorly optimised payment experience can undo all the effort you’ve put into bringing visitors this far.

Here’s how to create a seamless and reassuring payment experience:

- Diversify payment methods: Beyond credit cards, include e-wallets like Apple Pay or Google Pay, which are popular for mobile transactions. If you operate in multiple countries, offer local solutions like Bancontact in Belgium, Satispay in Italy, or iDEAL in the Netherlands. According to Baymard Institute, 13% of abandoned carts are due to the eshop not offering the right payment options.

- Offer payment facilities: Options such as one-click payment, split payment, or deferred payment can help overcome final purchase barriers and build customer loyalty. Nowadays, Buy Now Pay Later solutions such as Oney are very popular and can increase your average basket by 30 to 50%. [^1]

- Customise your payment page: Whether redirected or directly integrated into your checkout, your payment page should be simple, intuitive and consistent with your site’s overall design.

Our advice: Regularly test your checkout on various devices and browsers to identify and eliminate friction points. A well-optimised checkout leads to fewer abandoned carts and higher conversions.

Did you know that Hyvä Checkout is 13 times faster than traditional Magento templates? [^2]

In addition to speed, Hyvä allows you to customise your checkout experience with minimal hassle You can now easily create variations and A/B test which ones drive the best conversion.

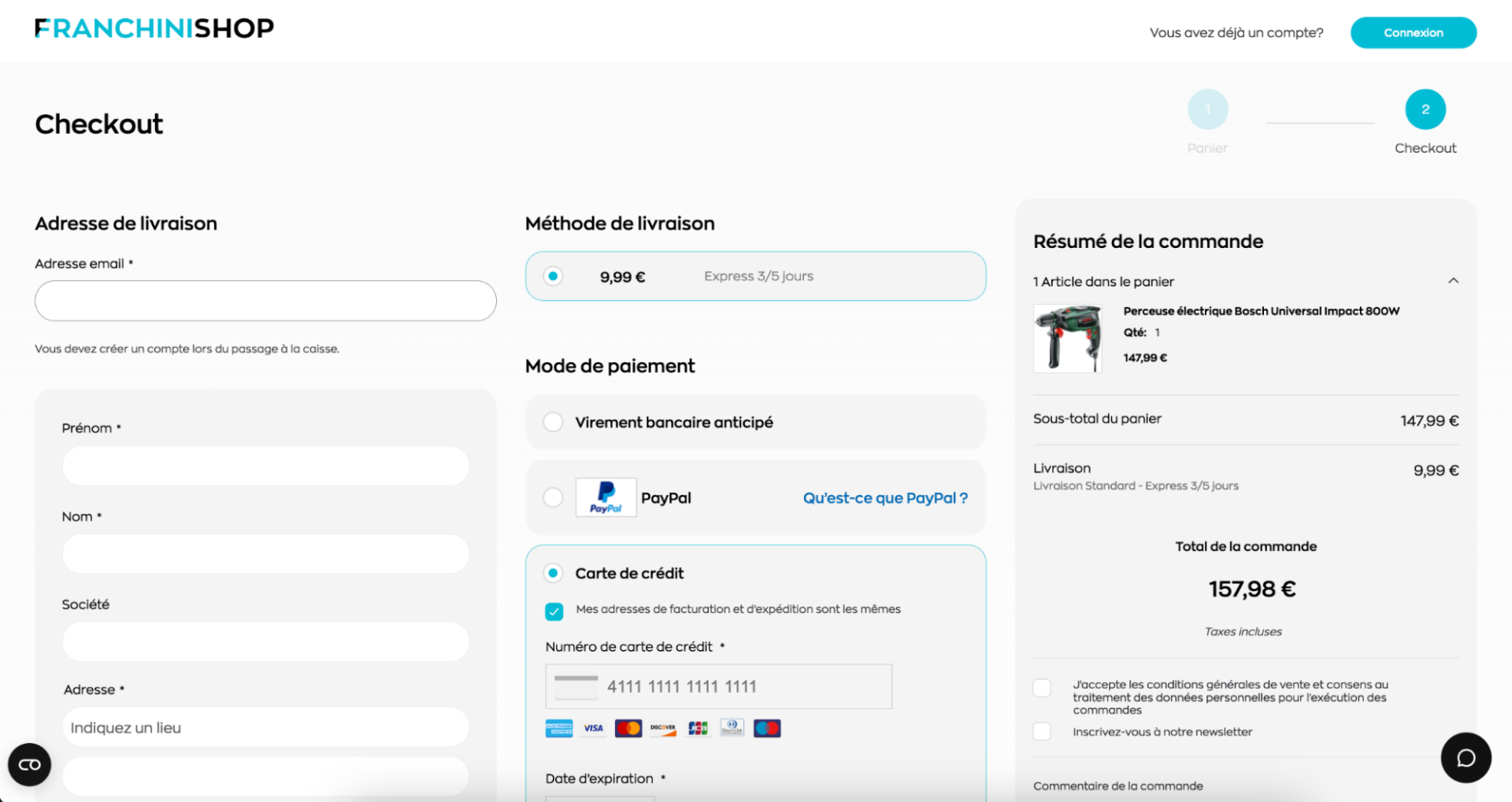

Integrated payment form on the ‘Franchini Shop’ website

3. Combat fraud while preserving conversion

Nearly 50% of payment failures [^3] are linked to errors in strong authentication. For instance, customers might not have their phone handy or take too long to authenticate via their banking app, resulting in lost revenue for e-merchants.

However, it’s possible to reduce these failures while complying with PSD2 security standards. Choose a payment solution that enables you to:

- Leverage strong authentication exemptions: Some solutions dynamically recommend frictionless authentication based on the risk level of each transaction.

- Reduce fraud rates: Besides direct losses from chargebacks, a high fraud rate can limit issuers’ (your customers’ banks) willingness to accept exemption requests.

Did you know? Merchants using Payplug’s Fraud Premium service see a 50% reduction in fraud and a 29% increase in frictionless payment journeys.

4. Boost payments locally

Every market has its own payment preferences, from commonly used methods to specific networks and key players.

Working with a local provider is a strategic way to improve payment performance and reduce costs:

- If the cardholder’s bank is in the same country as your payment provider (the acquirer), cross-border fees don’t apply, thus significantly lowering transaction costs.

- Local expertise from your PSP can enhance your acceptance rate and secure exemptions from regional issuers.

As part of Groupe BPCE, Europe’s leading issuer of Visa cards, and a principal member of the Cartes Bancaires (CB) network, Payplug offers the highest payment acceptance rates on 91% of French traffic.[^4] Payplug focuses on how to boost payment performance in Europe (and especially in France) but also addresses US merchants who want to sell their products in Europe.

Hyvä x Payplug: The winning combo for your e-commerce

Payplug offers a Magento payment module compatible with Hyvä Checkout. This combination unites Hyvä’s flexibility and speed with the power and stability of our payment platform, delivering a seamless shopping experience for your customers.

To turn every transaction into a growth opportunity, set ambitious goals, revisit your checkout process, adopt advanced anti-fraud tools, and adapt to local payment preferences.

Would you like to implement a tailored payment strategy with Payplug? Our teams are here to help—don’t hesitate to contact us!

Contact Payplug’s teams today